Hardhat Ltd

Stan Brignall, Aston Business School, Aston University

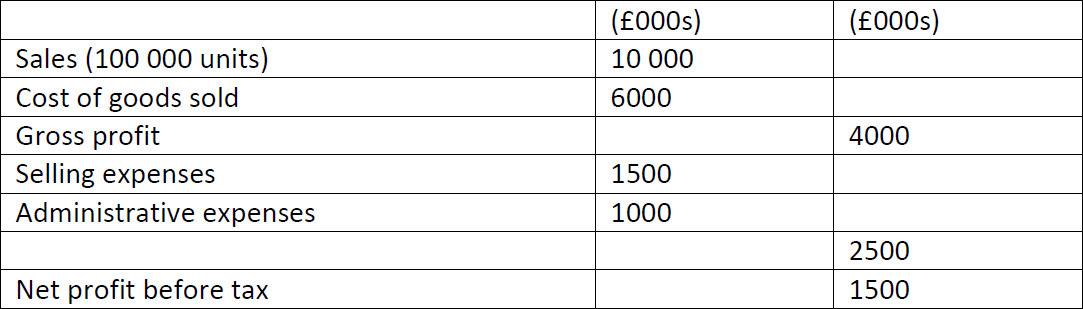

Hardhat Ltd: Projected income statement 2016/2017

After some discussion of information principally supplied by the Finance Director, John Perks, the Committee agrees the following changes for the 2019/2020 budget:

30% increase in number of units sold

20% increase in unit cost of materials

5% increase in direct labour cost per unit

10% increase in variable indirect cost per unit

5% increase in indirect fixed costs

8% increase in selling expenses, arising solely from increased volume

6% increase in administrative expenses, reflecting anticipated higher salary and other costs rather than any effects of the expected increased sales volume.

Write a report to the Board of Hardhat Ltd setting out the financial effects of the various proposals and make recommendations as to what price Hardhat should charge next year and in the longer run.

Your report and presentation should cover:

The sales price needed to earn the target profit, using the information compiled by the budget committee;

The number of units that would have to be sold at the old price to meet the target profit, and whether this seems feasible;

What the profit would be if the sales price calculated in (a) were adopted, but sales volume only rose by 10%, or at best 20%;

Any other factors you think should be taken into account when making decisions about the price to be charged next year, such as any change in risk involved in the cost–volume–profit structure you propose; the link between short- and long-run prices; and the interactions between acquisitions policy, financing decisions and pricing decisions.

Increased Budget:

The sales price needed to earn the target profit, using the information compiled by the budget committee; Assume Sales on $ = Sales = [Selling price per unit] * 130000

Sales - Variable cost = fixed cost + Net Profit Increased units = 130000

Sales = fixed cost + Net Profit +Variable cost = $ 13,504,800.00

So, Sales = [Selling price per unit]*130,000 ? [Selling price per unit] = $ 103.88

The number of units that would have to be sold at the old price to meet the target profit, and whether this seems feasible;

Assume Number of Units = U

Therefore Number of units Old = 32.44U - 1,620,000 =3,102,000 ? U = 145,561 units

What the profit would be if the sales price calculated in (a) were adopted, but sales volume only rose by 10%, or at best 20%;

Sales volume rise by 10% ? Number of Units Sold = 100,000 + 10% of 100,000 = 110,000

Therefore Net Profit with 10% increase in sales $1,353,200.00

Sales volume rise by 20% ? Number of Units Sold = 100,000 + 20% of 100,000 = 120,000

Therefore Net Profit with 10% increase in sales $1,676,400.00

Since we are aware that sales at the best case would increase by only 20,000, hence we would consider 120,000 as the break-even point to achieve the desired target. This would make us increase our selling price per unit to $106.58 per unit to achieve the profit of $2M Once the target is achieved, in the long run we would again reduce the price to previous price in order to maintain the customers trust and loyalty.

Any other factors you think should be taken into account when making decisions about the price to be charged next year, such as any change in risk involved in the cost–volume–profit structure you propose; the link between short- and long-run prices; and the interactions between acquisitions policy, financing decisions and pricing decisions.

Demand Analysis: Demand needs to be considered so as an accurate number of unit’s could be manufactured saving the inventory cost.

Break Even Analysis: Depending the profit target, the break-even point needs to be set. Depending the desired profit and the demand of the number of units, the price of the individual unit could be set. Once the break-even is achieved, the price could be further increased or decreased in the long run.